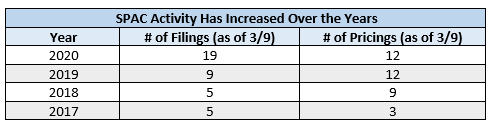

Record-high volatility and investor uncertainty have weighed on the IPO market in recent weeks, but blank check activity is as high as ever, indicating another banner year for the acquisition vehicles. So far in 2020, 19 SPACs have submitted initial filings with the SEC, a 111% increase over this date last year. With two SPACs currently on the IPO calendar and several more in the pipeline, YTD pricings will also have a lead over the previous year.

To screen for upcoming and past SPACs, sign up for a free trial of IPO Pro.

SPACs have a unique structure that acts as a buffer against broader market trends. A SPAC holds virtually no risk until completing its initial business combination, with investors able to redeem units ahead of a proposed acquisition. This "risk free" characteristic is valued by portfolio managers that must be invested in equities, and allows SPACs to continue launching and completing IPOs when other companies are sidelined by market turmoil.