Artificial intelligence (AI) is booming, and investors are seeking ways to capitalize on that growth. In addition to the billions poured into publicly-traded stocks like Nvidia, Microsoft, Meta, and Arm, venture funding for AI startups reached a new quarterly high in the 2Q. And as the number of well-funded startups rises, more AI-focused names will target IPOs in the coming years.

That's good news for investors that are interested in the next generation of AI companies, since the IPO market is the front door for new AI stocks.

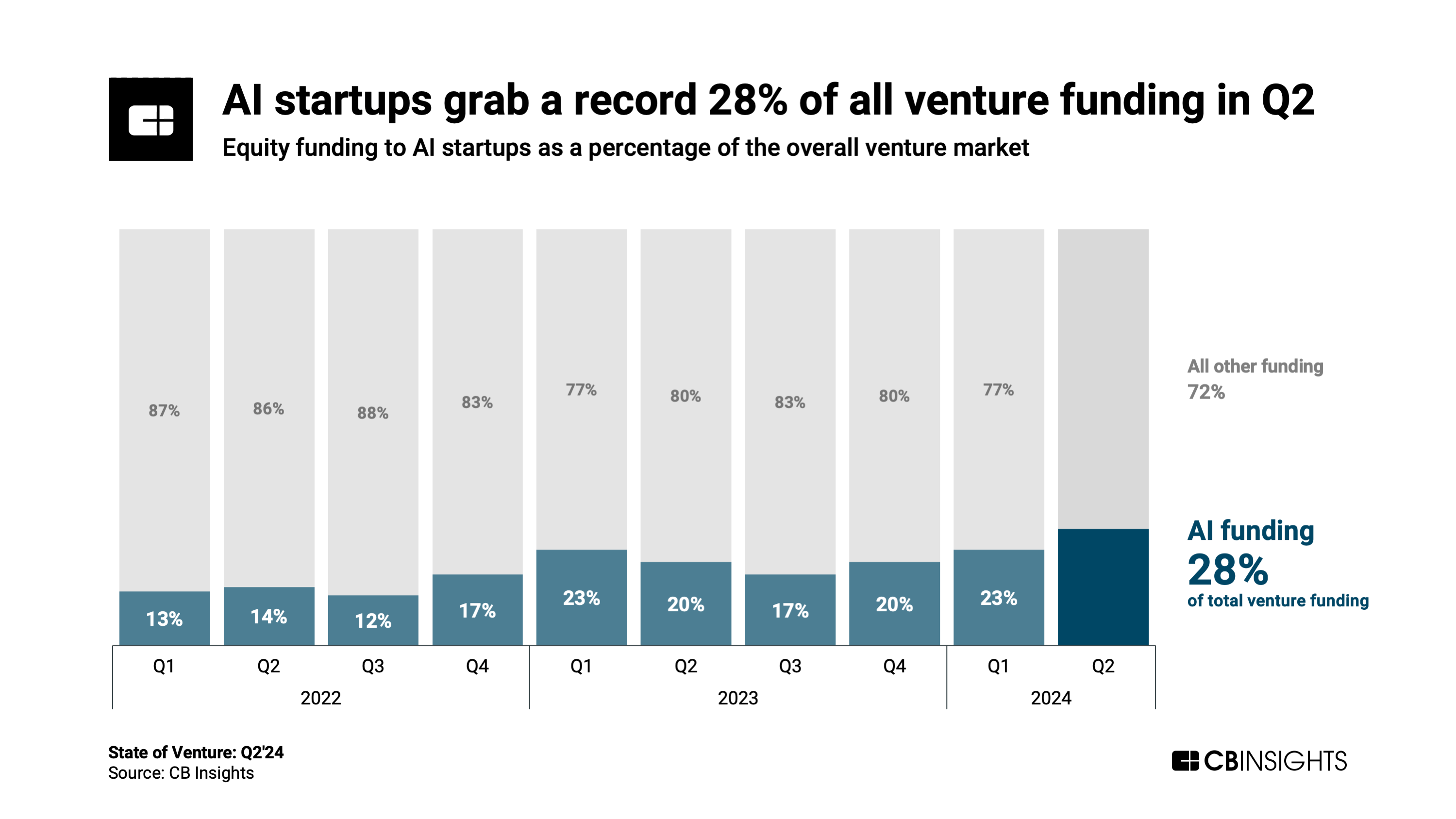

A new report from CB Insights showed that AI companies captured over $18 billion in venture funding in the 2Q. The report highlights mega-funding rounds from Elon Musk-founded xAI, as well as cloud computing firm CoreWeave (on our Private Company Watchlist), and AI development platform Scale AI (on our Private Company Monitor List).

As these companies continue to grow, IPOs start to become a "when" rather than an "if" as VCs look to cash in on their investments.

We've already seen several AI-focused IPOs, most notably chipmakers Arm (ARM) and Astera Labs (ALAB), which have benefited from the need for data centers that are optimized for AI. Social media company Reddit (RDDT) has soared since its March IPO, as it signed AI data licensing agreements.

Even so, investors are discerning, and not every company with an AI angle has been met with enthusiasm. Public investors have been warier of steep losses and capital-intensive projects. Precision medicine company Tempus AI (TEM) and data management platform Rubrik (RBRK) are two recent examples. And as more companies integrate AI into their product offerings, the line has blurred for what qualifies as an AI company: Recent IPOs such as digital rebate platform Ibotta (IBTA) and marketing software provider Klaviyo (KVYO) tout their AI integrations, for example.

Looking ahead, there is a growing backlog of mature private companies in the AI space that could go public in the near term, many of which are featured on our Private Company Watchlist (PCW). Below we highlight some AI-focused and AI-adjacent names from our PCW that are good candidates for IPOs in the next 24 months.

While there are plenty of AI companies that will likely remain private as the space continues to mature, including generative AI plays like OpenAI, there are still some solid candidates for listings in the medium term. Our Private Company Monitor List (PCML) includes a number of AI companies that may be on track for an IPO, but do not meet the criteria for our PCW. Below we highlight some AI-focused and AI-adjacent names from our PCML.