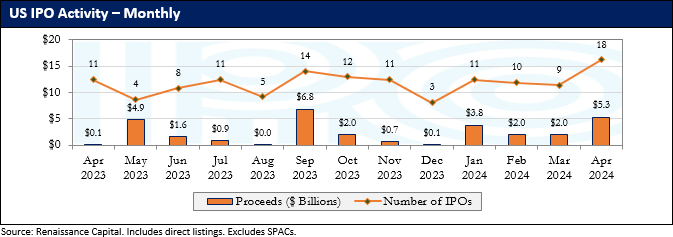

Eighteen IPOs raised a combined $5.3 billion in April, above the 10-year historical average by deal count and proceeds (16 IPOs, $3.7B). It was the busiest month for both overall new issuance and $100+ million IPOs since November 2021. Nine deals raised $100 million or more, led by the billion-dollar offering of cruise operator Viking (VIK). Large VC-backed tech continued to stage a comeback, with listings from data management unicorn Rubrik (RBRK) and digital rebate platform Ibotta (IBTA). Remaining activity came primarily from very small, Asia-based issuers, most of which finished below issue. The larger April deals averaged a 21% return from offer, while the broader group averaged 29%. The Renaissance IPO Index tumbled -10% in April, compared to -4% for the S&P 500, amid persistent inflation, lowered expectations for rate cuts, and heightened geopolitical tensions. New filings sank to a nine-month low, and while the pace of $100+ million filings (8) rose from the prior month (6), the public pipeline of larger deals shrank slightly. No blank check IPOs priced in April, and three submitted initial filings. Four SPACs announced mergers and four completed mergers, with more upcoming votes scheduled at month end. Despite some recent market headwinds, returns from recent IPOs and news from our shadow backlog give us optimism that the 2024 IPO market will continue to normalize heading into the summer.

To read the full article, sign up for a free trial of IPO Pro, the platform that gives you all of the IPO information you need, all in one place.